Delight Consultancy Services started in 8th Dec 2019. We started at small, with just a few people and a small office, but today we have offices in Muzaffarpur-Bihar with qualified and expert people. We are committed to deliver qualitative and value-added exceptional client service. We help you with all processes, obligations and compliances so that clientele can concerntrate on their business. We provide a wide range of services that include GST, TDS, INCOME TAX, TRUST, COMPANY, ACCOUNTING, MSME, FSSAI & Many more

Vision & Mission

Vision: To establish a one roof platform for clients for all their professional needs with the motive to be the Premier Accounting and Consultancy firm that provides excellent service to its clients and an excellent quality of professional life for our associates.

Mission: To provide reliable professional services with integrity, excellence and confidentiality in the system of our firm to meet our customer’s individual requests.

Our Beliefs: We believe in moral values and accept that there is no shortcut of quality professional services. Instead of being a distant service provider, we collaborate with our clients in all our engagements, work with them as a team and take ownership and responsibility of things, to create long lasting partnerships.

Our Ethics: We never compromise with the professional code of conduct, we abide professional ethics and would like to restrain ourselves from any conduct that might bring discredit to the profession. Our services are aimed at protecting our client’s interests. By adopting transparent processes and adhering to highest ethical standards, we ensure client confidentiality and our own credibility. Whilst collaborating with our clients, we remain absolutely independent to deliver unbiased opinions.

Read More..

Trusted Company

Expert Team

Great Support Team

GST Services – Simplifying Compliance for Your Business

At Delight Consultancy Services, we offer end-to-end GST solutions tailored to your business needs. From GST registration and return filing to input tax credit management, compliance checks, and consultation on complex GST ma...

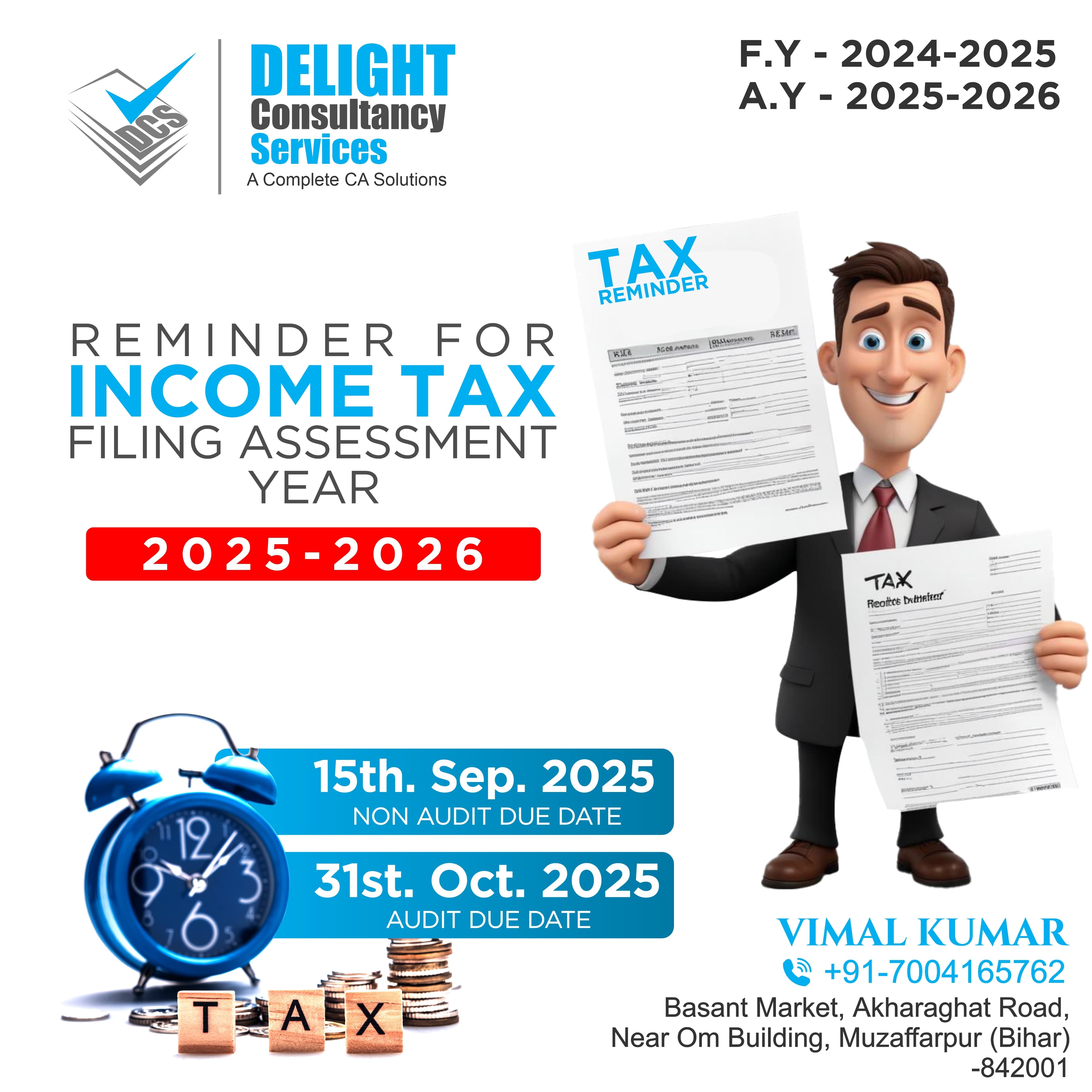

Income Tax Return (ITR) Filing Services

.png)

12AB & 80G Registration Services

If you run a charitable trust, NGO, or non-profit organization in India, 12AB and 80G registration are crucial for gaining tax benefits and enhancing donor confidence.

&nb...

NGO stands for non-governmental organization. While there is no universally agreed-upon definition of an NGO, typically it is a voluntary group or institution with a social mission, which operates independently from...

The word ‘Company’ has a strict legal meaning according to the provisions of the Companies Act of 2013, a company refers to a company formed and registered under the Companies Act. In common law, a company is...

Happy Clients

Certifications

Registrations

Successful Years

Best tax consultancy service ,professional and good behaviour with clients

Excellent services and good behaviour by all members and value for money

One of the best service provider in Muzaffarpur. I am totally satisfied their service

Positive: Professionalism, Quality work, Responsiveness, Value for money

Very good services by delight consultancy services thank you for on time delivered.

Excellent Service by Detight Consultancy Sevices and good support by all members thanks.

Delight consultancy Service has highly professional, sincere and experienced Team of Professional. Their level of service is awesome.

Delight Consultancy Service is one of the best CA in Muzaffarpur Bihar i have come across, his knowledge and concept in INCOME TAX and GST is awesome.

I have been associated with Delight Consultancy Service since 2019 when I had started my own Business in Patna Bihar.Even today he picks up my calls to answer smallest of the queries despite having

He is very professional with outstanding services and a systematic approach to all your needs.

Helped me with my accounts at an affordable price. Nice

Best CA firm in Bihar Muzaffarpur in comparison of all services it provides like Tax, Audit etc..

I found a desired infrastructure here and a very good exposure also..

I am overwhelmed to have great services by Delight Consultancy Services. One of the best NGO Consultants in Bihar.

One of the Best CA office In Bihar Muzaffarpur

Very professional in the handling of all kind of their clients for everything related to co. incorporate, all kind of Taxation, Audit, Filing ITR, etc. Mr Vimal is just a phone call away

One of the most trust his or her CA and in today's time its hard to find one whom you can rely on, Vimal Sir is an amazing professional who got my ITR field and processed without much hass

Quality and efficient working. Prompt responses to tax and corporate queries.

Simply put, it is the place for all types of business support

Delight Consultancy Services a business consulting company that can produce a complete CA Solutions . We are premium Business Solution Provider

Delight Consultancy Services started in 8th Dec 2019. We started at small, with just a few people and a small office, but today we have offices in Muzaffarpur-Bihar with Qualified and Expert people. We are committed to deliver qualitative and value-added exceptional client services.

Our firm strong customer base and deep industry knowlege helped us to expand in newer business horizon. We provide all kind of GST, TDS, Income Tax, 12A 80G Registration, Ngo Registration and Company Registration.

We have a wide domain/industry of clients, which itself is a prrof our best servces and have wide varied domain knowledge to provide consultancy to our esteemed clients. So far we have serviced more than 1000 + client pan India.

X